For much of the 20th century, salaries in Saudi Arabia were a tangible affair — quite literally. Workers at Aramco, the oil giant that helped reshape the Kingdom’s economy, were once paid in sacks of silver riyals. Before the advent of digital transactions and automated payrolls, wages were counted by hand — a scene now documented in the Aramco Community Heritage Exhibition.

Archival photographs from the 1930s and 1940s capture an era when financial institutions were few, corporate employment was novel, and the economy revolved around cash. Paying salaries wasn’t just a logistical exercise; it reflected a society in transition, where economic modernization was still on the horizon.

Beyond Aramco: A Regional Practice

Aramco, with its infusion of American capital and managerial systems, was pioneering for its time. Yet across the Kingdom — in trade, construction, and government — salaries were commonly paid in silver or paper riyals, often on a daily or weekly basis. In smaller towns where currency was scarcer, wages could take the form of store credit or basic goods.

This pattern echoed across the Gulf. In early Kuwait, oil workers were often paid in Indian rupees or British gold sovereigns before the Kuwaiti dinar was introduced in 1961. The UAE, prior to adopting the dirham in 1973, relied on Gulf rupees or cash bundles of Saudi riyals. Bahrain — the region’s early financial hub — moved faster, aided by its banking sector and the creation of the Bahrain Monetary Agency (now the Central Bank of Bahrain) in 1973.

Further afield, cash-based economies held out well into the late 20th century. In Egypt, government employees queued at state banks to collect envelopes of cash. In Iraq under Saddam Hussein, state-controlled salary disbursement could be delayed by conflict or crisis. The practice of physically collecting wages was not just common — it was expected.

The Rise of Saudi Finance

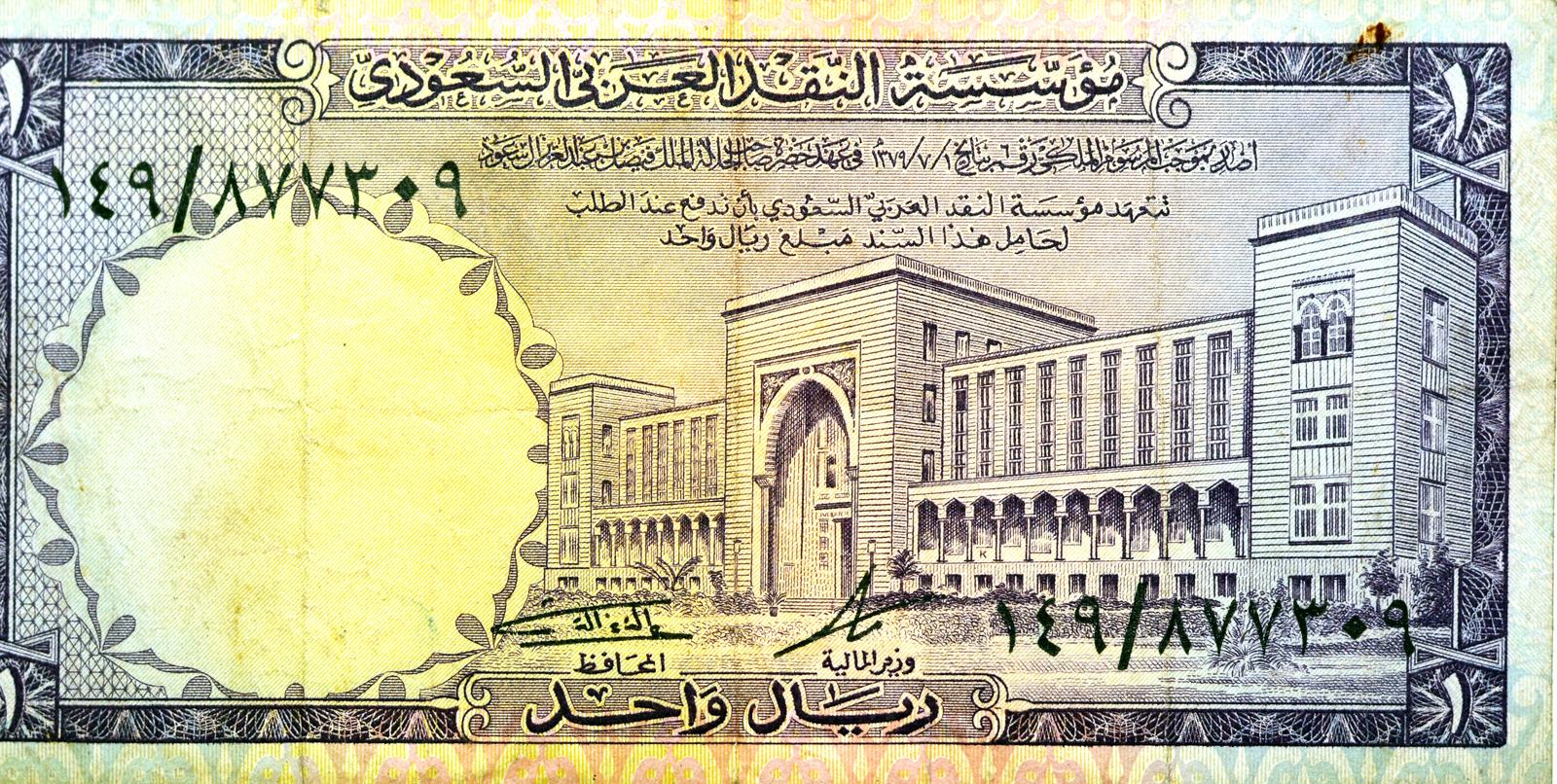

Financial modernization in Saudi Arabia began in earnest with the establishment of the Saudi Arabian Monetary Agency (SAMA) in 1952. The formalization of payroll systems gained momentum through institutions like the National Commercial Bank (NCB), which played a key role in integrating salaries into the banking sector. By the 1990s, the launch of the Saudi Payments Network (SPAN) linked ATMs and point-of-sale systems, paving the way for today’s digital economy. Now, salaries arrive not in sacks, but with the tap of a screen.

A Global Arc

Saudi Arabia’s transition mirrors global trends. In 19th-century America, miners in company towns were paid in proprietary tokens, redeemable only at employer-run stores. Edo-era Japanese workers were often paid in rice. In the Soviet Union, wages were sometimes distributed via ration cards, aligning income with ideology. The pattern is familiar: as financial institutions mature, salaries shift from physical to formal, from tangible to transactional.

More Than Nostalgia

The images in the Aramco archive do more than stir nostalgia. They trace the transformation of Saudi Arabia’s economic backbone — from a fragmented, cash-based system to a formalized, interconnected financial structure. In hindsight, such a transformation might seem inevitable. But progress required more than new technologies. It took institutions, policy frameworks, and public trust to reimagine how people are paid — and, in turn, how they live.

0 Comments

No comments yet. Be the first to comment!